Square Appointments is marketed as a flexible, easy-to-use app that allows small business owners and solo-preneurs to make use of online scheduling for their small business. It boasts a free plan for solo-preneurs, cancellation fees, client reminders, and calendar sync. Sounds like a perfect fit for small business owners at first glance…

In this article we will be discussing the features of the Square Appointments app as well as some frustrations that many independent professionals have with it.

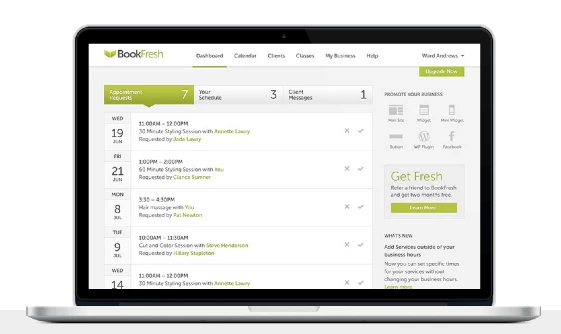

The history of the Square Payments app lies in the acquisition of BookFresh, an appointment scheduling app.

The strategy behind this seems to be for Square to acquire businesses that share commonalities in terms of being different “tools that Square could offer through their core merchant experience.”

Sounds perfect! Now you can set up online booking and manage your appointments from the Square app, right? Not so fast…

INTEGRATION DIFFICULTIES

Unfortunately, as opposed to integrating BookFresh features into their main app, Square chose to keep the apps separate, which means more confusion and complexity for small businesses.

BookFresh was a pre-seed startup and was never integrated in the Square platform. It is siloed, which means independent businesses need to download and use multiple apps.

There are some ways to integrate the two, but they are far from robust.

One option actually requires a third-party app to integrate everything. A third app! You should visualize me shaking my head right now because that’s bonkers.

DEPOSITS AND CREDIT CARDS

Another drawback is the fact that you can’t take deposits – you must submit a payment request twice, once for the deposit and another time for the payment.

You also can’t store your customer’s credit cards on file, which makes it inconvenient because you need to ask for the credit card each time you do a transaction. Imagine how cumbersome that becomes for repeat clients!

CUSTOMIZATION CHALLENGES

Additionally, the ability to customize the app is definitely lacking.

The rigid structure of the app is reminiscent of Square’s other apps – namely, the main POS app as well as the Cash app.

Your head will be spinning by the time you’ve figured out how to customize anything that pertains to your workflow. There’s no way to collect any additional information from clients when they book you, nor can you get them to sign any waivers or contracts.

LIMITED CALENDAR SYNC

The app also features a Calendar sync, which can be helpful if you’re currently using Google Calendar.

Which is great… unless you’re using iCal. Where’s the integration with one of the most popular calendars in the world, the default Mac calendar?

There was an online request for this on the Square Seller Forums back in 2016, with zero responses.

Another difficult thing about setting up Calendar sync is that you must do it on desktop – there’s no way to set up calendar sync between Square Appointments and Google Calendar on your mobile. How dated is that!

TECHNICAL ISSUES

The appointment app has also run into multiple technical hiccups which resulted in unhappy customers. Eventually the engineering team intervened to solve the issue, but it had to be debated in a public forum (rather than advocated for by a dedicated support team) in order to resolve it. Hmm!

You’d think a company that prides itself on its dedication to small business owners and solo-preneurs would be able to handle the issue offline instead of having their dirty laundry out for everyone to see.

In another public fiasco, customers using Square Appointments were appalled that the app didn’t have the capability to display their availability properly, resulting in these business owners missing out on appointments.

As a small business owner, I can assure you that every single possible customer that I can get for my business matters a whole lot.

It can be the difference between being profitable this month and bleeding red (losing money).

So I need a solution that is going to work properly and display my availability correctly.

Just imagine a client books an appointment with your business that you can’t honor because you have a scheduling conflict! That’s nerve-wracking to you because you have to reach out to try and reschedule, possibly losing the client forever.

It’s also frustrating to the customer because they were probably searching awhile for a service provider that is available at the specific time that they need.

Once they confirmed with you, you doubled back and informed them that now you can’t do that appointment…

This looks unprofessional, feels frustrating, and usually results in the customer canceling the appointment completely because they’ve lost confidence in you and your business.

Unacceptable!

EMPLOYEE DIFFICULTIES

What if you have employees? At the 5-10 employees range, you’re paying upwards of $90 per month.

How about if you have more than 10 employees? You’re paying a pretty penny (they call it a ‘custom price’ for software that should cost about $90 per month, when you could have unlimited employees for about the same price.

It’s strange that the more I try to expand my business, the more money I have to pay for the exact same technology. Does that sound predatory to you? It does to me.

RAISING FEES

As Square continues to hike fees, desperate business owners are looking at less expensive and less bloated alternatives in order to continue to run their business lean and profitable.

As Erik Sherman from Inc.com points out:

“2.75 percent of $21,000 is $577.50, which is $302.50 higher than the old monthly fee. If you can swipe all the transactions, then the only way to keep your fees with Square under that $275 number is to process no more than $10,000 in monthly transactions. Not exactly a smart goal for an entrepreneur.”

As a small business owner, I can agree with that. Why is it that whenever you try to become more successful, there are forces pushing you back down and punishing your success?

It takes an iron-willed business owner to pay that much in transaction fees, especially once you get into the $20 – $40k per month range. Isn’t that the goal, though? Sounds like a great incentive *not* to grow your business.

MISSING FEATURES

At the very least you’d expect an app that’s charging *that* much to provide some extra features besides appointments and online booking, right?

For example, where is the ability to store payment information for recurring clients?

What about information about your clients in general? I’d like to be able to take notes about my clients’ preferences in the same app, not have to bust out a notepad. That’s just unprofessional.

And don’t even get me started on business messaging. As we’ve discussed previously, business messaging is a critical tool for business owners for multiple reasons:

- Easier to separate business from personal

- Group messaging is a breeze

- Ability to send out automated SMS campaigns with discounts, promos, etc. to generate more bottom line income

Where is this capability in the Square Appointments or main Square POS app? Nowhere to be found, to the chagrin of all Square clients.

PocketSuite is a great alternative to Square Appointments for the following reasons:

- Everything packaged in 1 app – run your whole business with it

- No excessive fees

- Business Messaging included

- Smart Campaigns included

- iCal integration included

- Flat rate for unlimited employees

- Responsive customer service team

Try PocketSuite for free today and transform the way you run your business, forever. You won’t want to miss this!

Like this article? You’ll love our guide on how to generate leads for service businesses in 2022, and of course our Frustrations with Square article!

Learn how PocketSuite compares to other booking apps: